r&d tax credit calculator 2019

The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. RD tax credits generated in 2017 can be used to offset payroll taxes come mid-2018 and RD tax credits.

The R D Four Part Test Cheat Sheet Rd Tax Credit Software

During this conversation we will.

. ASC RD Tax Credit Calculation 15000. The RD tax credit as prescribed in 26 USC. SNs RD Tax Credit Estimator is an estimate only.

Use our simple calculator to see if you. How to calculate the RD tax credit using the traditional method. Home RD Tax Credits Calculator.

Get Started Now Qualified Expenses. The Tax Credit Calculator is indicative only and for information purposes. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

RD tax losses 230 of RD spend 115000. Heres your RD Report. The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US.

Compared to the same quarter in 2019 In 2021 has your business experienced a quarter with a revenue reduction of at least 20. 114-113 made the RD tax credit permanent and added a provision permitting eligible startup companies. The results from our RD Tax Credit Calculator are only estimated.

Your actual numbers will vary depending on additional more detailed. Plus it carries forward. Our RD tax experts will quickly assess if you are eligible for RD tax credits.

For most companies the credit is worth 7-10 of qualified research expenses. The credit benefits companies of any size in every industry and yet people leave the money on the table. Find Out If You Qualify For The RD Tax Credit.

Weve Been In Your Shoes Want To Help. Weve Been In Your Shoes Want To Help. Calculate RD tax relief in under 3.

Dollar-for-dollar reduction in your federal and state income tax liability. 41 may be claimed by taxpaying businesses that develop design or improve products processes formulas or software. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion.

RD Tax Credit Calculator. The next step is easy. Use our simple calculator to see if you qualify for the RD tax credit and if so by how.

W2 wages for technical staff. See If Your Business Qualifies For RD Tax Credits. This is a dollar-for-dollar credit against taxes owed.

The Protecting Americans From Tax Hikes Act of 2015 PATH PL. A tax credit generally reduces. You take 50 or half of this amount which is 40000.

Companies to increase spending on research and development in the US. --Select-- 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 Enter Current Year. These benefits can include the following.

For what year are you estimating your credit. RD Tax Credit Calculator. Estimated restricted cash benefit.

Dont Leave Your RD Tax Credit On The Table. Find Out If You Qualify For The RD Tax Credit. Up to 12-16 cents of RD tax credit for every qualified dollar.

And so the RD tax credit has been revised to give more instant gratification. What is the RD tax credit worth. The rate of relief is 25.

Call us at 208 252-5444. The RD tax credit is a tax incentive in the form of a tax credit for US. Estimate Your RD Tax Credit.

Provide ideas to maximize your current and past claims. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. RD Tax Credit Calculator.

So if your RD spend last year was 100000 you could get a 25000 reduction in your. Based on the information. This credit appears in the Internal Revenue Code section 41 and is.

Estimate Your Federal RD Tax Credit. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. Dont Leave Your RD Tax Credit On The Table.

With a 100 success rate qualified and experienced staff and sector specialists at our disposal we make the process quick and hassle-free. Congress has enacted powerful government-sponsored incentives that can significantly reduce your companys current and future years federal and state tax. Get a free estimate of the RD tax credits your company is eligible for.

It should not be used as a basis for calculations submitted in your tax. Tax losses including RD relief. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

How To Fill Out Form 6765 R D Tax Credit Rd Tax Credit Software

R D Tax Credit Calculation Examples Mpa

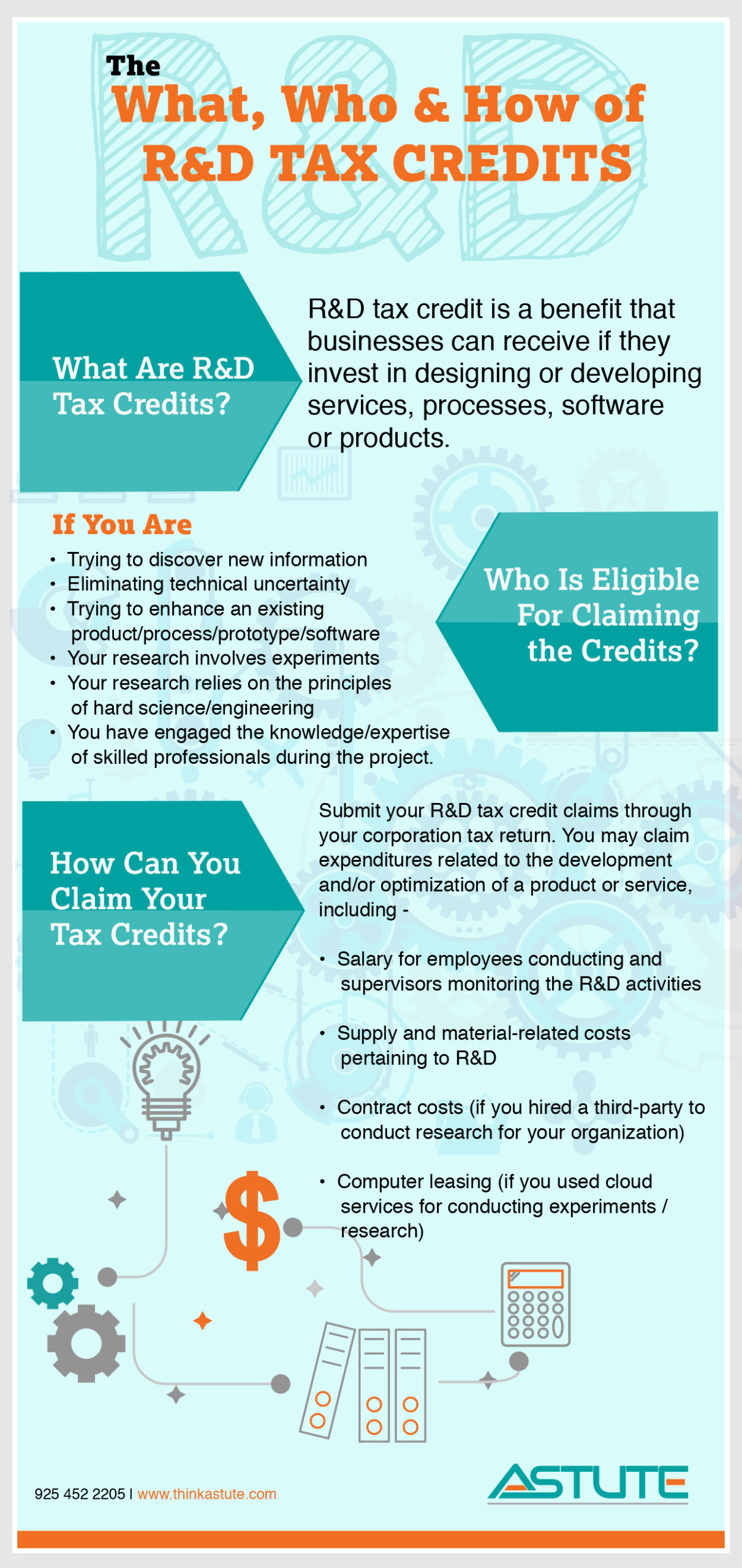

Are You Eligible For R D Tax Credit Find Out Using This Infographic Astute Tax Accounting Services

Hmrc R D Report Template 1 Professional Templates Report Template Templates Professional Templates

Everything You Need To Know About R D Tax Credits Astute Tax Accounting Services

R D Tax Credit Calculation Adp

R D Tax Credits For Architects

Tax Credits For Digital Marketers The R D Tax Credit Tax Hack Accounting Group

Rise In Claims For R D Tax Credits Amongst Smes Mpa

R D Tax Credits For Architects

How The R D Tax Credit Rewards Job Shops And Contract Manufacturers

R D Tax Credits For Architects